Industry Asset Valuation: Strategic Methods Beyond Traditional Accounting

Effective asset valuation practices offer industrial enterprises critical insights beyond balance sheets. By implementing advanced valuation methodologies, companies can make strategic decisions about capital allocation, equipment replacement cycles, and competitive positioning. While financial statements provide historical perspectives, modern industrial valuation incorporates performance analytics, market conditions, and technological obsolescence factors, enabling organizations to maximize operational efficiency and capture hidden value in their asset portfolios.

Understanding Industrial Asset Classes

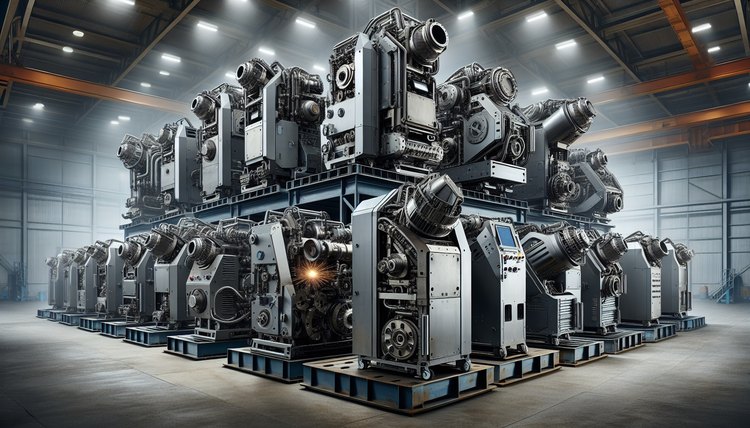

Industrial assets span a diverse spectrum requiring specialized valuation approaches. Heavy machinery, production lines, and specialized equipment form the backbone of manufacturing operations but present unique valuation challenges. These assets typically experience non-linear depreciation patterns influenced by technological advancements, market demands, and maintenance histories. Unlike standard financial assets, industrial equipment values correlate strongly with productivity metrics, energy efficiency ratios, and compatibility with emerging manufacturing methodologies.

Additionally, intellectual property assets like patents, proprietary manufacturing processes, and technical know-how constitute a significant yet often undervalued component of industrial portfolios. These intangible assets frequently represent competitive advantages that traditional accounting methods fail to capture adequately. Real estate holdings, including specialized facilities with industry-specific modifications, require contextual valuation that considers location advantages, supply chain proximity, and adaptability to changing production requirements.

Transportation fleets and logistical infrastructure assets compose another category with valuation complexities tied to fuel efficiency standards, maintenance records, and regulatory compliance factors. Proper classification and categorization of these diverse assets establish the foundation for effective valuation strategies that extend beyond simplistic book value calculations.

Performance-Based Valuation Methods

Traditional asset valuation relies heavily on historical cost minus depreciation, a method increasingly inadequate for modern industrial operations. Performance-based valuation approaches offer more nuanced and relevant assessments by incorporating operational metrics directly into valuation models. This methodology evaluates assets based on their contribution to productivity, efficiency, and overall business performance rather than merely their accounting book value.

Key performance indicators suitable for industrial asset valuation include Overall Equipment Effectiveness (OEE), capacity utilization rates, energy efficiency ratios, and mean time between failures. By analyzing these metrics longitudinally, companies can identify high-performing assets worthy of retention or investment despite accounting age. Conversely, newer equipment showing suboptimal performance metrics may warrant earlier replacement or modification than traditional depreciation schedules would suggest.

The performance-based approach also incorporates opportunity cost analysis, examining how current assets compare against available alternatives. This comparative framework enables management to identify equipment that, while functional, may be constraining production capabilities or increasing operational costs. Progressive industrial organizations implement continuous valuation systems that track performance metrics in real-time, creating dynamic asset valuations that inform capital allocation decisions with greater precision than annual accounting reviews.

Market-Responsive Valuation Adjustments

Industrial asset values fluctuate in response to market conditions far more dynamically than traditional accounting recognizes. Market-responsive valuation approaches incorporate external factors such as industry-specific demand cycles, technological disruption patterns, and global supply chain shifts. These methods help businesses maintain realistic asset valuations aligned with actual market conditions rather than theoretical depreciation schedules.

Specialized industrial equipment markets exhibit unique pricing behaviors influenced by industry consolidation, technological standardization trends, and regional manufacturing shifts. For instance, equipment serving industries experiencing rapid geographic relocation may face significant valuation changes independent of age or condition. Equipment with cross-industry applications typically maintains stronger residual values compared to highly specialized machinery limited to single-industry applications.

Secondary markets for industrial equipment provide valuable comparable transaction data, though interpreting this information requires careful analysis of equipment specification differences, operational history, and installation costs. Forward-looking market assessments incorporating industry forecasts, regulatory change projections, and technology roadmaps enhance traditional valuation approaches with predictive elements that anticipate future value shifts before they impact financial statements.

Technological Obsolescence Factors

Industrial assets face accelerating technological obsolescence in today’s rapidly evolving manufacturing landscape. Modern valuation methodologies must account for this phenomenon by incorporating technological lifecycle assessments into traditional valuation calculations. The technical relevance of equipment often deteriorates faster than physical condition, creating a valuation gap between book value and practical utility.

Key technological obsolescence factors include compatibility with current manufacturing systems, energy efficiency compared to newer alternatives, digital integration capabilities, and alignment with evolving industry standards. Equipment lacking modern connectivity features may face functional obsolescence despite mechanical soundness as manufacturing environments increasingly demand data integration and remote monitoring capabilities. Similarly, equipment designed for materials or processes being phased out due to sustainability initiatives or regulatory changes faces accelerated value decline beyond standard depreciation curves.

Proactive obsolescence management involves regular technology benchmarking against industry standards and emerging alternatives. This practice identifies assets approaching technological obsolescence before productivity impacts become apparent. Technology risk factors should be quantified and incorporated into valuation models through adjusted useful life estimates or specific obsolescence reserves that more accurately reflect true equipment value in technologically dynamic industrial environments.

Strategic Valuation for Competitive Advantage

Forward-thinking industrial organizations leverage valuation insights as strategic tools rather than mere accounting exercises. Strategic valuation approaches assess assets within the broader competitive landscape, identifying how equipment portfolios enhance or constrain market positioning. This perspective transforms asset management from a cost-centered maintenance function to a strategic capability driving competitive advantage.

Valuation methodologies supporting strategic decision-making include scenario planning with variable production requirements, competitor capability assessments, and strategic flexibility analyses. Assets offering operational flexibility to adapt to changing market demands or product specifications often warrant premium valuations beyond their current utilization metrics. Similarly, equipment portfolios allowing rapid scaling or product diversification provide strategic optionality that traditional valuation methods typically undervalue.

Industrial organizations gaining competitive advantage through valuation practices implement systematic asset strategy reviews that connect equipment capabilities directly to market opportunities and competitive threats. These reviews identify critical capabilities requiring investment protection and legacy systems constraining strategic initiatives. The resulting insights guide capital allocation decisions aligned with long-term competitive positioning rather than short-term financial metrics, ensuring industrial assets serve as strategic enablers rather than operational constraints.

Practical Industrial Asset Valuation Techniques

-

Implement tiered valuation frequencies matching asset criticality—quarterly reviews for production-critical equipment, annual assessments for supporting systems.

-

Develop custom depreciation models for specialized equipment that incorporate industry-specific obsolescence patterns rather than standard accounting schedules.

-

Create composite valuation scores combining financial metrics with operational performance indicators and strategic importance ratings.

-

Establish baseline performance metrics for each equipment class, allowing comparison between actual asset performance and expected capability benchmarks.

-

Document tribal knowledge regarding equipment modifications, maintenance history, and operational quirks that impact practical value beyond visible condition.

-

Incorporate regional factors affecting secondary market values, including local industry concentration, technical support availability, and transportation logistics.

-

Analyze correlation between maintenance investment and value retention to optimize maintenance resource allocation across the asset portfolio.

Effective industrial asset valuation extends far beyond accounting compliance to drive strategic advantage and operational excellence. By implementing multidimensional valuation approaches that incorporate performance metrics, market conditions, technological relevance, and strategic importance, manufacturers gain clearer visibility into their true asset value. This enhanced perspective enables more informed decisions about equipment investment, maintenance prioritization, and capital allocation. As industrial competitive landscapes continue evolving at accelerating rates, sophisticated asset valuation practices increasingly distinguish market leaders from organizations constrained by outdated equipment and valuation methodologies.